|

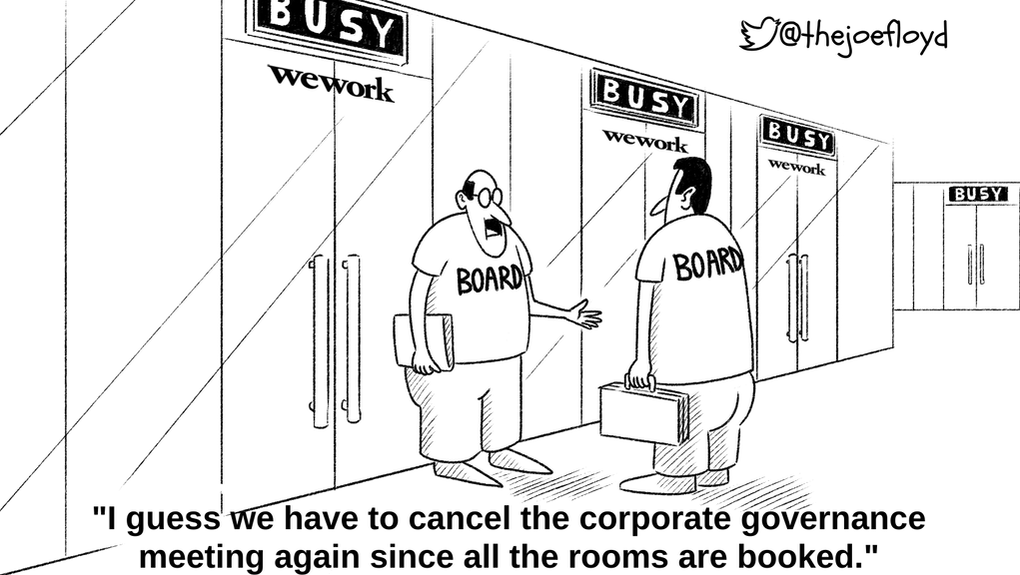

WeWork raised $12.8B in equity and debt financing from high profile investors such as Benchmark, Goldman Sachs, T Rowe Price, Wellington and of course SoftBank. That’s a lot of people and opportunities for a board to provide fiduciary oversight. And yet, CEO Adam Neumann was able to treat corporate governance like a joke:

At what point did the investors stop and try to curb Adam’s power? Apparently only after the public markets decided the company was worth less than ⅓ of the last private price. The story of WeWork should serve as a wake up call for private investors to take their fiduciary duties on private boards seriously. Oh wait, Uber and Travis Kalanick already provided that wake up call. Hmm...wait a second, don’t Uber and WeWork share investors? Yep...SoftBank, Goldman Sachs and Benchmark. Guess the third time’s the charm.

Comments are closed.

|