|

According to a Sarah Lacy article from earlier this year, Andreessen Horowitz almost had an iron clad rule to never invest in verticals. The main reason to avoid vertical investments was because they had small addressable markets and thus it was difficult to build a big business.

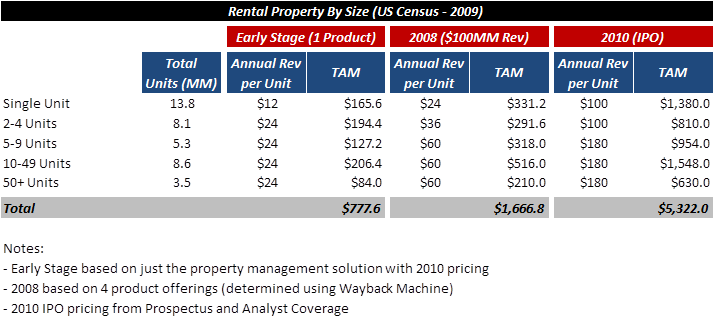

Thankfully, Emergence ignored traditional thinking and bet early on Veeva Systems (NYSE: VEEV). What did we see that made us think it was a big enough market? We had a core thesis that SaaS made verticals more attractive. SaaS products can evolve faster than on-prem deployments and thus, we believed vertical SaaS applications could achieve high levels of customer satisfaction by combining vertical market expertise with rapid, focused iteration. This customer satisfaction would enable vertical SaaS vendors to perfect a use case and then sell additional products and services to their happy customer base. Let’s look at RealPage (NYSE: RP) as an example. RealPage sells web-based property management solutions to the multifamily real estate industry. Using the 2009 US Census, I used a bottoms-up approach to calculate total available market size for RealPage with their initial product at ~$780MM. By 2008, RealPage had expanded its product offering and increased ASPs almost doubling their market size to ~$1.7B. Lastly, at the IPO, analysts projected future growth in product offerings which tripled market size to ~$5B. |

Sign Up to Receive Posts via Email

All

|