|

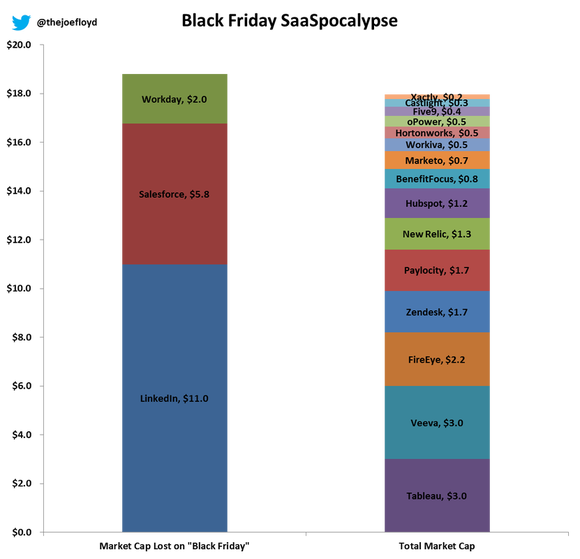

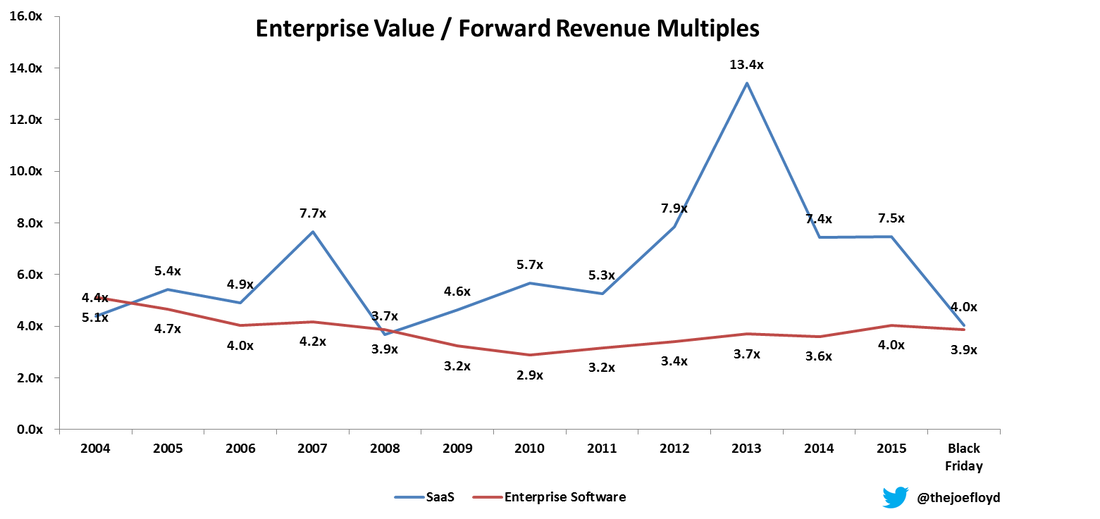

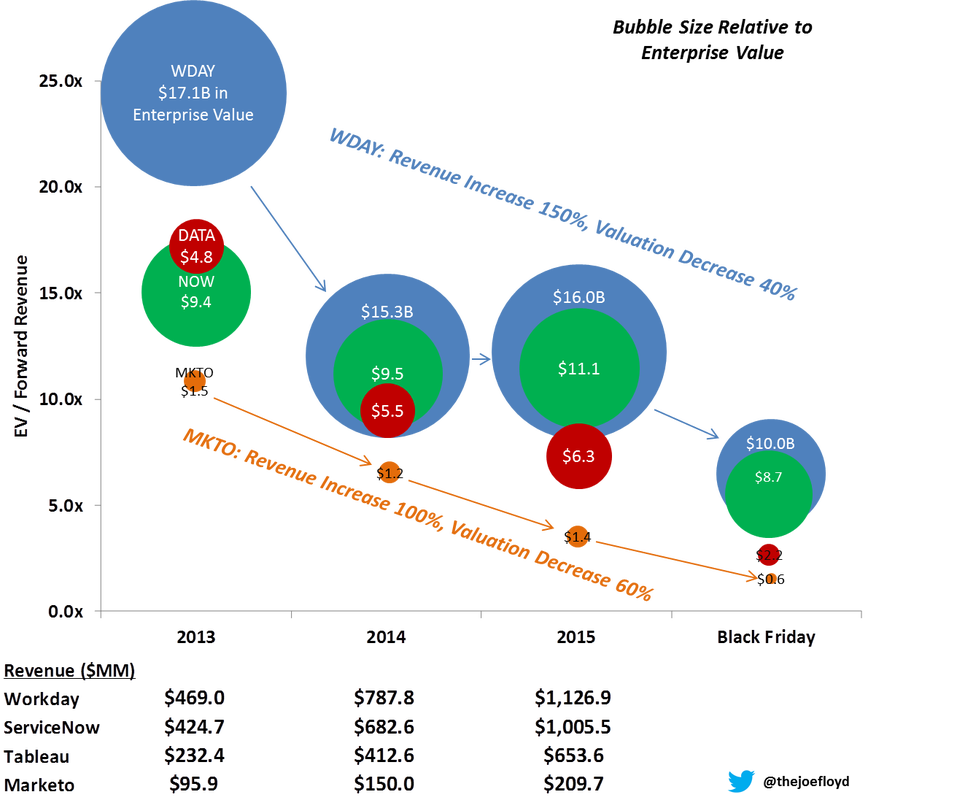

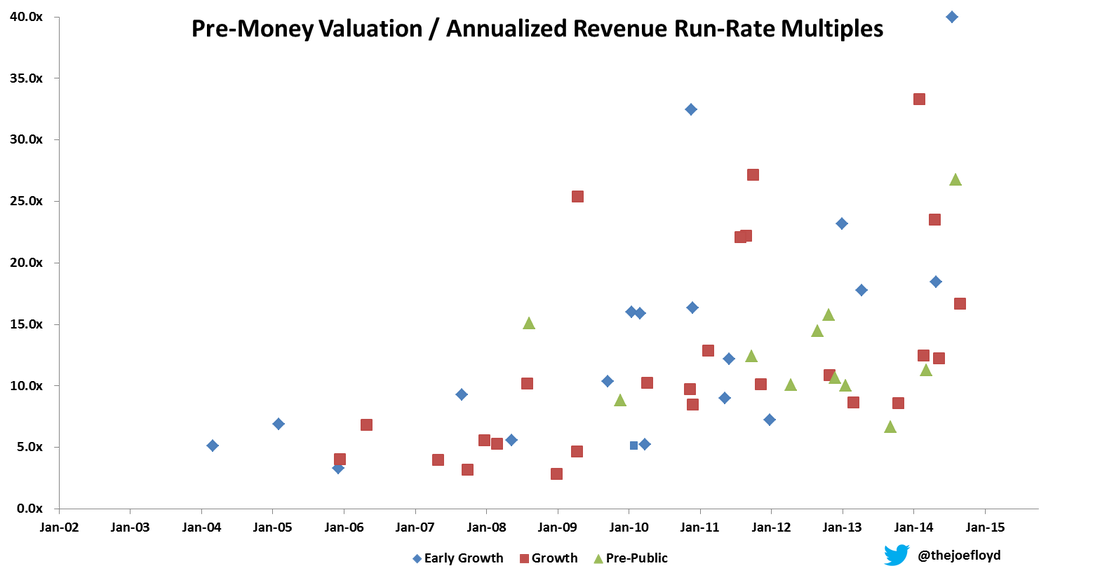

Last Friday, LinkedIn, Salesforce and Workday lost $18B in market capitalization. To put that in perspective, these three SaaS companies lost more in market cap on Friday than 15 current SaaS leaders are worth…combined. How can this be possible? LinkedIn, Salesforce and Workday are growing revenue with sticky customers and they are targeting large addressable markets. Are they now suddenly undesirable companies? Investors Paid Yesterday for Today’s Growth On the contrary, public SaaS companies have largely met growth expectations and performed according to Wall St. expectations. The problem is that investors already paid for the projected revenue growth in many SaaS stocks a full 2 years earlier. Let’s look at historical multiples of Enterprise Value / Forward Revenue for the past decade. As you can see below, enterprise software multiples have largely held steady at 3-4x forward revenue. However, SaaS multiples began diverging in 2012 from their historical range of 5-6x forward revenue. This divergence peaked at the end of 2013 and has remained elevated above historical averages for 2 more years. The Black Friday correction brought SaaS multiples back in-line with enterprise software valuations. Like many corrections, the market has overshot to the downside as we at Emergence believe long term SaaS valuations of 5-6x forward revenue will return. Note: Enterprise Software = Microsoft, Oracle and SAP. SaaS = Athenahealth, Castlight, Concur, Cornerstone, Dealertrak, FireEye, Marketo, Netsuite, Realpage, Salesforce, ServiceNow, Splunk, Tableau, Veeva and Workday. Growth Cannot Outrun Multiple Compression Recurring revenue business models are highly valued for recurring revenue and predictable growth engines. But what happens when predictable growth is no longer valued at predictable multiples? In the chart below, you can see what has happened to 4 of the hottest IPOs of the last few years. Workday has grown revenue from $470MM to over $1.1B in 2 years and yet their market value is down 40%. Marketo has doubled revenue over the last 2 years and their market value is down 60%. This is a really painful lesson for shareholders - it does not matter how fast revenue is growing if multiples are compressing faster. There are number of factors that drive valuation multiples: future growth rates, operating margin and addressable market to name a few. For most of the public SaaS companies, the two main drivers of multiple compression have been decreasing revenue growth rates and diminishing risk appetite of investors. Lessons for SaaS Entrepreneurs So what does all of this mean for SaaS entrepreneurs? To be blunt, the issue of multiple compression is an even bigger challenge for valuations of private companies. Unlike the public markets which have regular earnings that ignite valuation changes, the private markets have very few catalysts for change. Private valuations have been driven upward by an abundance of capital pushing valuations higher and higher. You can see evidence of this trend in the scatterplot below of private SaaS valuations from the last decade. Note: Early Growth = $2-5MM ARR. Growth = $5-20MM ARR. Pre-Public is $20MM+ ARR. I excluded certain outliers.

Similar to the public markets, SaaS valuation ranges began expanding in 2012. Unlike the public markets, private market valuations remained elevated through 2014. I purposefully truncated the data at the beginning of 2015 so as not to give away too much proprietary information. However, I will say that 2015 continued the trend until Q4 when fundraising became noticeably tighter – particularly in angel rounds and late stage rounds. The direct impact of a contraction in multiples is only felt when entrepreneurs are fundraising and the end result for the market is more flat/down rounds and more situations where a startup has to drastically cut burn. Here is a scenario that I’ve seen play out multiple times in the last 3 months. Hot SaaS startup raised a large Series A 12 months ago: $8-10MM at a $40MM post-money valuation. The company projected 2-300% growth on a base of $1MM ARR. Because they raised a large A, they accelerated hiring to hit aggressive growth targets and they are now burning $600K/month. Now, that same SaaS startup is at $4MM ARR and they want to raise $20MM and they expect a valuation of $100MM. Only now, multiples have compressed to 10x ARR. The entrepreneur does not like the dilution of $20MM in a flat round so there is a hard decision to make: raise less and drastically cut burn or raise what you need and suffer dilution. This situation can become a vicious cycle as sustaining growth is critical for future fundraising. This scenario oversimplifies the fundraising process and certainly every situation is different. However, the point I want to make is simple. The best entrepreneurs and best companies will be just fine fundraising even with a tightening market. It’s the startups with challenging cap tables, cost structures or market timing issues that will really struggle to fundraise. Black Friday isn’t the canary in the coal mine – it should be the last wake up call for SaaS entrepreneurs to take a good look at their business and make absolutely certain that they have a contingency plan for 18 months of cash. P.S. If you want to preserve cash without cutting costs, here are 5 cash flow hacks for SaaS startups. This post originally appeared in TechCrunch. In October, I published this article in TechCrunch on how to tell if your SaaS startup was burning money too fast. That blog post spawned a number of great conversations with entrepreneurs on how to measure and control cash burn. The ugly truth is that startup CEOs have to walk a fine line with cash burn: spend too little and your startup may not grow fast enough to achieve escape velocity; spend too much and your startup might run out of life.

“Why don’t I just spend money to experiment and then dial back when it isn’t efficient?” – This line of thinking is perfectly logical but the simple truth is that it just isn’t very easy to cut costs without hurting employee morale, disrupting culture and killing your revenue momentum. However, given the SaaS business model, you can apply a little financial hacking to conserve cash without cutting spend. Here are my top 5 SaaS financial hacks: 1. Focus on annual contracts and collect the cash up front. Sales reps are naturally inclined to go for the monthly sale – it seems easier because it is a smaller commitment. That’s true, but it kills your cash flow in a couple ways: one, monthly contracts churn at a higher rate than annual; and two, monthly contracts require a long time to pay back the initial sales and marketing cost to acquire that customer. For example, let’s say your gross profit pays back customer acquisition cost in 9 months. That means you are cash flow negative on that customer for the first 9 months and you will take a permanent loss if that customer churns in that time period. Now, let’s assume you only sign annual contracts with payment up front. That same customer is immediately cash flow positive and you can never take a permanent loss because their first opportunity to churn is at the 12 month mark. It sounds simple because it is. Incentivize your sales team to sell annual contracts and incentivize your customers through small discounts to pay upfront. 2. Implement faster and thus invoice faster and upsell faster. “Awesome, my sales team just sold an annual contract, but where is the cash?” For most enterprise customers, you do not invoice your customer until your application is implemented and live. For customers that require integrations, training and set up time, this presents a significant delay. Improve your cash flow by compressing the time from signed contract to live deployment. Plus, you’ll get an added bonus – the faster a new customer goes live, the faster your customer success team can upsell additional features and more seats. 3. Match sales commissions to cash flow. “Wait a second! While I’m waiting for implementation to finish, I’ve already paid out the sales commission so my cash flow is even more negative.” That’s right! That’s why forward thinking sales leaders find ways to match the timing of sales commissions to the cash flows of new contracts. There are many different ways to do this without causing too much disruption. The key is to make sure reps see the new system as fair and transparent. 4. Extend accounts payable and speed up collections of accounts receivable. I am constantly amazed by how quickly startups pay their bills. It’s time to start thinking like a big company – maximize your float and set up your bills to be automatically paid close to their due date. More importantly, don’t let your customers borrow from you interest free for 90 days. Test the best way to improve the speed with which your customers pay you – you can discount for early payment, you can send invoices early and you can even just try using personal charm on the accountants. If a company with $6MM in revenue can bring its accounts receivable days outstanding from 90 days to 60 days, the net gain is $500K in cash. 5. Shift capital expenses to operating expenses. Capital expenses for startups are items like office leases, furniture and computer equipment. For example, office leases may require hefty deposits or payment upfront and furniture is often purchased in advance of new hires. You can save cash by shifting these fixed expenses into monthly rentals. SaaS startups already face an uphill battle given the business model of initial customer acquisition costs which are paid back over time by subscription revenue. Using these 5 SaaS financial hacks can conserve cash and extend your runway without reducing spend in your product or sales organizations. Questions about cash burn have blazed through Twitter like wildfire. Entrepreneurs are asking us: How do I know if I am burning money too fast? Unfortunately, there is no one-size-fits-all answer for an entrepreneur on what level of burn is appropriate for their startup. However, every entrepreneur should consistently assess their runway and revise spending against their strategic goals.

I have designed this short quiz to help enterprise cloud startups analyze their spending levels. It’s critical to monitor your company’s burn rate so you can make those quick adjustments to increase your chances of success. Select the answers below that best describe your company. 1. Market Dynamics: Does your market have network effects? a) Each sale is independent. If we sell to one customer it does not impact the likelihood of sale to another customer. b) Economies of scale are important in our market and we believe that only three or four solutions will achieve scale. Early movers have a small advantage. c) Every new customer increases the value of our product and becomes a source of new potential customers. Early movers have a major advantage. 2. Competitive Intensity: Who are your major competitors? a) We are in a dogfight with a number of well-funded startups and large incumbents. Our sales team consistently sees competition for new customers, and we win as often as we lose. b) We are competing with one or two large, entrenched companies. Our sales organization sees competition more often than not, but we win most of the time. c) We are carving up a green-field opportunity. We sometimes face competition for new business but it is usually from consultants or internal teams building custom solutions. 3. Customer Retention: What is our churn? a) We estimate that we turnover 1 out of every 4 customers each year. We haven’t really started tracking churn yet, but I would guess that our net annual MRR churn is ~20 percent. b) We track churn and we know we retain 85-90 percent of our customers annually. We have increased our average sales price by 10 percent over last year. We also have a customer success team that upsells our most engaged customers, so our net annual MRR churn is only 10 percent. c) We track each cohort of customers on a monthly basis and our customer success team excels at deploying new customers quickly and getting them engaged. We have negative MRR churn, and each monthly cohort continues to grow over time. 4. Sales and Marketing Efficiency: What is the return on every dollar of sales and marketing spend? a) We spend $1 – $1.5 in sales and marketing for every dollar of total bookings (new and renewal). We do not worry about gross margins because we know they will increase with scale. We collect some contracts monthly, quarterly and annually. b) We achieve a 1:1 ratio of sales and marketing spend to new annual contract value (ACV) bookings. We analyze customer acquisition costs (CAC) by channel, and we tend to payback CAC with gross profit in 9 – 12 months. We try to get cash payment up front for annual contracts. c) We consistently receive $2+ dollars of new ACV bookings for every dollar of sales and marketing spend. We optimize CAC by allocating marginal spend to the highest performing channels. Gross profit pays back CAC in less than 6 months consistently. Our customer success team is deploying signed contracts quickly, and we always collect cash up front for our contracts. 5. Fundraising Capability: Who is in your investor syndicate and how easily can you add new sources of capital if you need to fundraise quickly? a) We have a group of angel investors or constrained institutional investors. It feels too early to pursue debt. We are heads down focused on sales and product right now and we will think about the next fundraising when we need to raise more money. b) We have one institutional lead investor with dry powder, and we think we can secure a small debt facility. Our investor can introduce us to venture firms so we can start a fundraising process pretty quickly if we need to do that. c) We have two or more institutional venture investors and we have a small debt facility with our bank that we can draw down if we need it. We keep a steady dialog going with investors that we would like to involve in future financings so we could start a process tomorrow if desired. What’s your score? Give yourself one point for each “A” answer, three points for each “B” answer, and five points for each “C” answer. 0-10 points: Pull the ripcord. You need to evaluate your spending immediately and consider pulling back drastically. You may be too early in a nascent market, and it would be wise to conserve capital until the market develops. You may be facing too many competitors which is forcing everyone to spend inefficiently. You may want to scale back sales and marketing while you pivot your product to find a more attractive competitive position. Lastly, you may not be able to raise additional equity if the current venture environment sours. You should look to secure a debt facility and reduce burn to give your team the longest possible runway to succeed. 11-18 points: Pump the brakes. You are not in trouble yet, but you should quickly assess your situation. If you are targeting a large enough market, then you may be justified in continuing to spend on sales and marketing even if you are not that capital efficient. However, you should drill down and figure out why you are not efficient. Do you have a churn problem? Do you face too much competition? Do you have too many sales reps? Not enough good sales reps? Are you marketing in the right channels? Is your pricing right? Is your product truly solving a customer pain point? Once you understand the drivers of your current business, you can reduce spend in the areas that are not efficient. For example, if you do not quite have product-market fit, then you can reduce sales. If you do not have sales functioning perfectly, you can reduce marketing spend. Lastly, you should consider raising a top up round to give yourself 18 months of runway while the venture fundraising window is open or securing a debt facility to give yourself an extra 6-9 months of cushion. 19-25 points: Burn baby burn. Your sales and marketing engine is firing on all cylinders and you have proven you know how to engage customers and keep them renewing. Now is the time to pour fuel on the fire to attack your market while there is little competition. The viral effects are strong enough to justify the investment now, and investors will reward you for your efficient growth. Remember to keep monitoring your SaaS metrics so you can adjust your spend if your business slows down. Lastly, you should consider raising additional growth equity early while the venture window is wide open and valuations are aggressive. Editor’s Note: Joe Floyd is a venture investor at Emergence Capital. Emergence focuses on enterprise cloud applications and has invested in market leaders including Yammer, Box, Veeva Systems and Salesforce. This post originally appeared in TechCrunch. Lured by the success of companies such as Workday and Marketo, consumer internet and mobile entrepreneurs have flooded into enterprise startups.

This new wave of entrepreneurs has leveraged their consumer DNA to reimagine the way enterprise users consume software. They have injected beautiful design and streamlined user experiences, which make their software seem both fresh and familiar to users in a business setting. However, the best product does not always triumph in the land of long sales cycles, custom integrations, and the dreaded procurement officer. In order to win in enterprise markets, startups need to build world-class marketing, sales and services organizations. Today’s product-centric entrepreneurs should follow in the footsteps of market leaders such as Box, Yammer and Veeva Systems and reevaluate these three common startup myths from the consumer internet: Myth #1: If our product is great, then word of mouth virality and organic search will generate the web traffic necessary to drive growth. Organic search and word of mouth virality are great for acquiring individual users, but they are not sufficient for grabbing enterprise decision makers. For example, Box has a freemium product with virality built-in through file sharing. This customer acquisition channel can generate enough paid conversions to sustain meaningful growth at the consumer and small to medium business levels. However, when it comes to generating enterprise leads, demand generation techniques are absolutely necessary to feed an enterprise sales team. Box uses a combination of content/influencer marketing, paid search/display advertising, conferences and channel partners to target and build a pipeline of decision makers. Myth #2: If our product is easy to try and customers can sign up with a credit card, then I do not need expensive sales reps to sell it. Self-service sales models work very well in situations with single decision makers and low price points. However, self-service models break down at the enterprise level. Yammer built a great self-service model where SMBs or managers within an enterprise could sign up a team with a credit card. Yet when it came to enterprise-wide sales, Yammer discovered that inside and direct sales reps were necessary to manage and win enterprise contracts. In particular, sales reps are able to sell to multiple decision makers within an organization, push contracts through procurement, compete in RFPs and negotiate service level agreements and integrations. Myth #3: If our product is designed so that it is intuitive and easy to use, then I will not need professional services. Low or no-touch service models are critical for consumer startups given the scale of their customer base. However, customer success and professional services organizations are critical for success with enterprise customers. Veeva Systems has built a world-class services organization that provides three key strategic advantages:

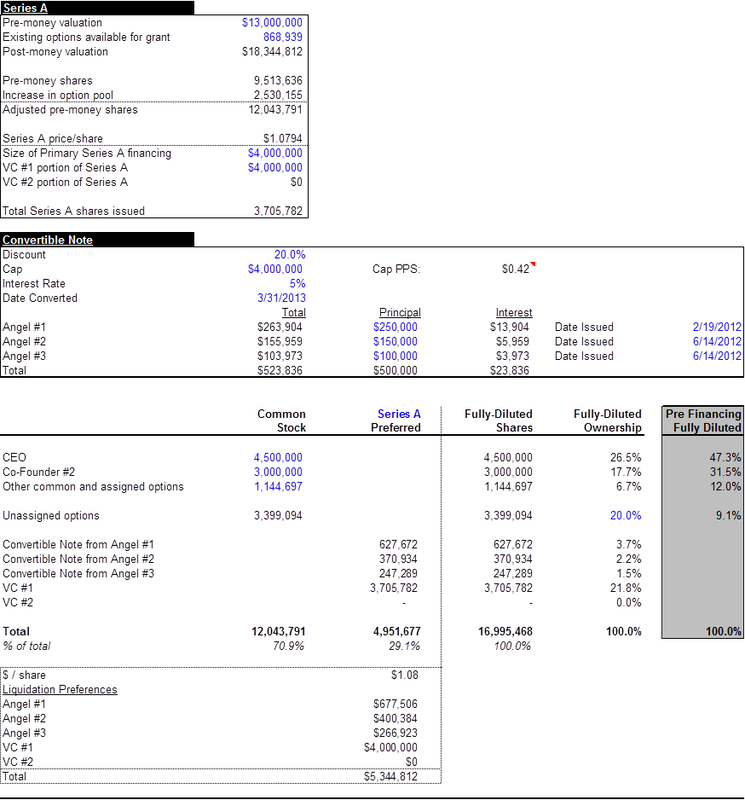

When consumer startups scale, they require capital to expand the product and support the user base. Conversely, when enterprise startups grow, they require capital to scale sales, marketing and services. When an enterprise startup is seeking a Series A investment, veteran investors will not expect that the CEO has definitively cracked the code on scalable demand generation, predictable sales and customer success. However, we absolutely want to see that startups have experimented to test hypotheses in each of these categories. Designing experiments, tracking metrics and iterating quickly are critical proof points that allow entrepreneurs to earn trust with investors because it demonstrates that they will spend capital efficiently. Consumerization of IT has led to a renaissance of enterprise software. Now that entrepreneurs are designing delightful enterprise products, they cannot ignore the need to build the sales, marketing and services engines necessary to deploy that software into the hands of enterprise users. As more enterprise solutions are coming to market, VCs will be even more discerning as they decide where to invest, so it is important for entrepreneurs to not fall prey to the myths of the consumer internet. This post originally appeared on Entrepreneur. Mark Suster wrote a great post covering why convertible notes can be a hidden tax on entrepreneurs. This topic has also been fairly well covered by a number of high profile Silicon Valley law firms so I’ve just constructed a spreadsheet to demonstrate the actual mechanics and allow you to play with the inputs. In the example above, you can see that $500K of convertible notes winds up with ~$1.3MM in preferences and ~7.3% ownership because of the $4MM cap. That’s 1/3 of the ownership that the VC gets in a priced round for ~8x the money! After you’ve downloaded the spreadsheet below, you can enter in your expected scenario in the cells with blue font. Once you have your expected scenario, you may want to graph the ownership changes and a liquidation waterfall... but I’ll save that for another day. :)

|

Sign Up to Receive Posts via Email

All

|

||||||