|

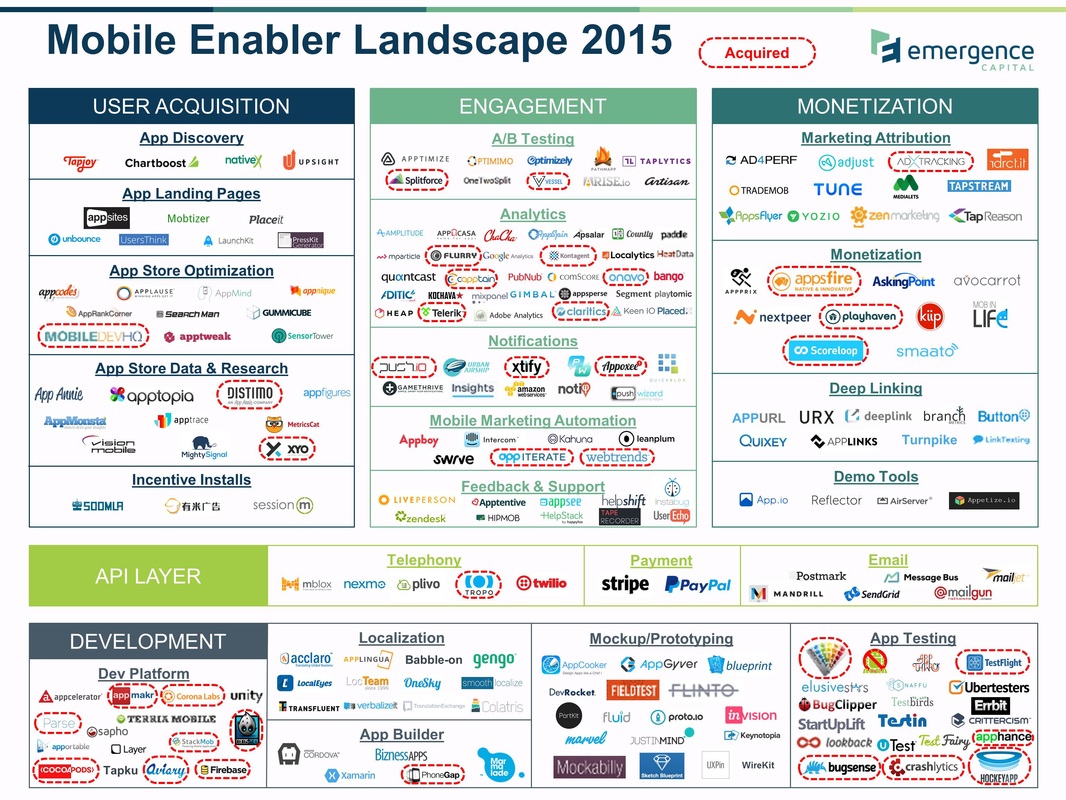

Over the past three years, the Emergence Capital team has closely monitored the growing ecosystem of mobile enterprise applications. We have been fortunate to learn from our investments in a few of the early leaders across this landscape, including Box (collaboration), Doximity (digital health), ServiceMax (field service) and Cotap (enterprise mobile messaging). As we continue to watch the enterprise mobile app landscape develop, we have begun to formulate a thesis on the evolving ecosystem of SDKs (software development kits), APIs (application programming interface) and development platforms that mobile entrepreneurs are utilizing to accelerate the development, marketing and monetization of their mobile apps. Collectively, we are referring to these companies as the Mobile App Enablers, and we are starting to see some early trends. The landscape and industry trends we are sharing today are based on conversations with over 200 mobile app entrepreneurs and business leaders. We segmented the landscape of enabling technologies into three main layers:

Note that we specifically avoided categories like mobile ad networks or mobile device management. Within the landscape’s three main segments, we have identified the following key insights:

Incumbent Web App Technologies Are Not the Leaders in the Mobile World Mobile app development is fundamentally different from web app development – from the programming languages to the hardware resources available to run an app and ultimately to the app store distribution model. As a result, web app technology incumbents do not have an advantage in most categories. For example, mobile specific development platforms such as Parse have emerged to solve very specific mobile app development pain points related to mobile devices and operating systems. We also found that the proliferation of mobile hardware created a new problem that could only be solved by mobile focused app testing startups like Crittercism. Lastly, with app stores serving as the gateway for user acquisition and monetization, we found that startups like AppAnnie (app store data) and ZenMarketing (attribution) started to solve very specific needs that their web counterparts like comScore and Convertro were not solving. The one major exception to this trend is that the API leaders which power the web also power mobile apps – Twilio for telephony, Stripe for payments and SendGrid for email. This makes perfect sense as developers are familiar with them and there is no real advantage for a mobile specific API technology in these general categories. There are a number of web incumbents who aggressively evolved their products to target mobile – Optimizely, Zendesk and Google Analytics are three examples. These companies should be lauded for their agility but they also face stiff competition from mobile specific startups and we will watch how their markets unfold. Mobile SDKs Need to Fight for Mindshare Due to app store approval processes, mobile app development cycles are slower than their web app counterparts. Also, the capabilities and storage of mobile devices are limited. As a result, mobile app developers are simply not willing to integrate an infinite number of SDKs. This has led mobile enabling technologies to fight for mindshare at the earliest stages of app development. Once a mobile app has integrated one analytics SDK, the bar for ripping it out and replacing it with a competitor is very high. We have observed the most successful SDKs like Mixpanel have targeted developers early with freemium offerings. Consequently, we have observed that getting your SDK distributed widely with freemium has enabled early leaders like Flurry to evolve their product offerings into other areas. Point Solutions Are Evolving into Suites Enabling technologies focused on driving engagement face stiff competition as illustrated by the highest density of logos on the landscape. As a result of this competition, we have seen this area evolve tremendously over the last six to twelve months. Companies like Leanplum and Swrve have moved from A/B testing to include customer segmentation and messaging. Mixpanel has evolved from analytics to include marketing automation features. Kahuna and Appboy have grown from just mobile marketing automation to email marketing and have displaced web incumbents like ExactTarget in accounts. This evolution is partially driven by market size and competition but also by the desire of customers to start paring down the number of vendors they integrate into their apps. The Fight on the Horizon As we look ahead, we know the number of mobile enterprise apps will continue to grow and this will benefit the ecosystem of enabling technologies. However, as enabling technologies mature, competition will increase – both from other startups and from the web incumbents who rapidly attempt to catch up. We anticipate consolidation within the major categories on our landscape, particularly as the early leaders broaden their capabilities into product suites. We realize that we have likely missed some great companies, so please let us know if we missed you. Also, if you are thinking about other frameworks to categorize mobile enabling technologies, we would welcome sharing ideas. Away from the fickle eyes of consumers, deep in the basement of app stores, enterprise mobile apps are fighting each other for the attention of business users. Given the restrictions of their target audience, business app developers simply cannot utilize the same techniques that consumer app companies leverage. Why is that? And more importantly, how can mobile business apps efficiently speed up user acquisition?

Customer Acquisition Models For Consumer Apps First, let’s examine the methods consumer app developers have used to efficiently acquire large user bases and why business app developers cannot leverage the same techniques. Obviously, consumer apps have a large target audience as everyone with a smartphone is a potential customer for a consumer app. As a result, the size of the target audience is capable of generating enough web and app-store search volume to build an initial customer base for apps. Plus, the undifferentiated nature of consumers means that cross promotional advertising on consumer apps can be a very effective and efficient user acquisition technique. For example, an advertisement for a mobile game can appear on any mobile app and the end user is always a potential target. On the contrary, the target audiences for business apps are often much smaller and may be focused on a particular vertical niche such as doctors or real estate professionals. As a result of the smaller target audience, business apps do not see a sufficient level of web and app-store search volume. Further, cross promotional advertising is much less effective because of the niche target audiences. For example, less than 1% of US smart phone users are doctors, which makes it very difficult to target that vertical with display ads. Lastly, consumer app developers with deep pockets have been known to game app store rankings. At the launch of a new consumer app, the developer can pay for downloads through services, such as Chartboost and Tapjoy, until they crack the top 25 of an app store. At that point, their visibility on the app store leaderboard increases their discoverability to the point where organic downloads can take over. Given their smaller target market, mobile-first business apps simply cannot compete with consumer apps for space in app-store rankings (there are no business apps in the iOS Top 50 as of this writing). Building Virality Into Enterprise Apps Now that we’ve explored what is not working for enterprise mobile apps, let’s focus on what is working: designing your product work flows to drive direct exposure to new potential users and building in opportunities for indirect referrals through word-of-mouth virality. Dropbox is the quintessential paradigm of designing virality into a product. Users are incentivized to refer Dropbox because they receive free additional storage for doing so. Additionally, the act of sharing a file with a friend inherently exposes Dropbox to new potential users and serves as a trigger for customers to talk about the service. Building on the lessons learned from Dropbox, there are three techniques that emerging mobile-first business app developers are using to build virality into their products: triggers, incentives and work flow. Triggers are events that spur an action. In this particular context, triggers are actions that an app user takes which provide for an opportunity to discuss the application. Expensify, a mobile app for business users to submit expense reports, has built in two word-of-mouth referral triggers: 1) every time a user takes a picture of a receipt for expense reporting, they are triggered to talk about the app with the coworkers or clients present; 2) the act of submitting an expense report triggers an explanation of the product to the person approving the report. Incentives play on the concept that users are much more likely to actively refer a product if they receive some practical value for doing so. Plangrid, an iPad app for managing construction-site blueprints, uses incentives to spread among the different companies that collaborate on construction sites. Plangrid’s value to each site user increases with each additional company and user that joins and adds to the project. Thus, users have a practical incentive to refer the product to new target users. Lastly, building virality directly into the workflow of how a customer uses an app is a very effective way to expose the app to new potential users. Doximity, a mobile professional network for physicians, has built virality into its product workflow through its secure messaging capability. Doctors use Doximity to send HIPAA compliant messages to other doctors. Every message sent from a user to a doctor not yet on the platform exposes a new potential user to the product as the message recipient must install Doximity to read the message. Key For Enterprise Apps Mobile-first business apps have to follow different rules for customer acquisition in order to achieve the scale and marketing efficiency of their consumer-focused brethren. The key for enterprise apps is to focus on building virality into the product so users directly or indirectly spread the app within their target audience. The mobile-first business apps that emerge victorious will be the ones that leverage triggers, incentives and work flow to kick their user acquisition flywheel into overdrive. This piece originally appeared in TechCrunch. |

Sign Up to Receive Posts via Email

All

|