|

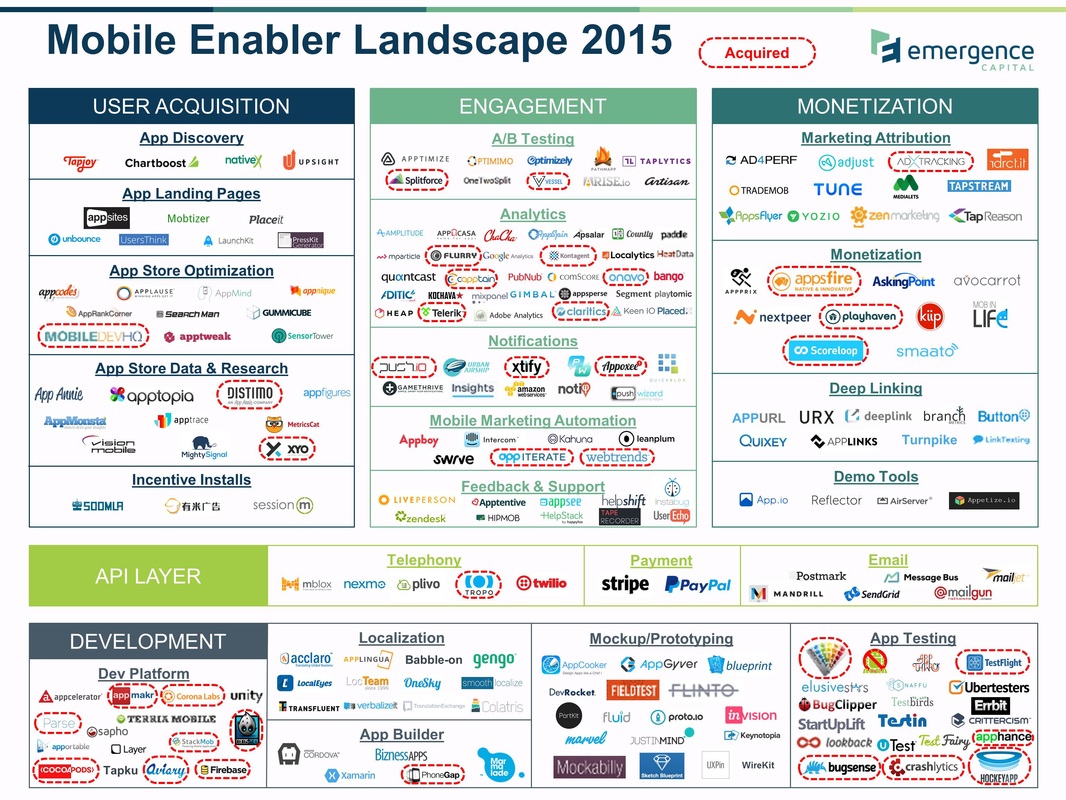

Over the past three years, the Emergence Capital team has closely monitored the growing ecosystem of mobile enterprise applications. We have been fortunate to learn from our investments in a few of the early leaders across this landscape, including Box (collaboration), Doximity (digital health), ServiceMax (field service) and Cotap (enterprise mobile messaging). As we continue to watch the enterprise mobile app landscape develop, we have begun to formulate a thesis on the evolving ecosystem of SDKs (software development kits), APIs (application programming interface) and development platforms that mobile entrepreneurs are utilizing to accelerate the development, marketing and monetization of their mobile apps. Collectively, we are referring to these companies as the Mobile App Enablers, and we are starting to see some early trends. The landscape and industry trends we are sharing today are based on conversations with over 200 mobile app entrepreneurs and business leaders. We segmented the landscape of enabling technologies into three main layers:

Note that we specifically avoided categories like mobile ad networks or mobile device management. Within the landscape’s three main segments, we have identified the following key insights:

Incumbent Web App Technologies Are Not the Leaders in the Mobile World Mobile app development is fundamentally different from web app development – from the programming languages to the hardware resources available to run an app and ultimately to the app store distribution model. As a result, web app technology incumbents do not have an advantage in most categories. For example, mobile specific development platforms such as Parse have emerged to solve very specific mobile app development pain points related to mobile devices and operating systems. We also found that the proliferation of mobile hardware created a new problem that could only be solved by mobile focused app testing startups like Crittercism. Lastly, with app stores serving as the gateway for user acquisition and monetization, we found that startups like AppAnnie (app store data) and ZenMarketing (attribution) started to solve very specific needs that their web counterparts like comScore and Convertro were not solving. The one major exception to this trend is that the API leaders which power the web also power mobile apps – Twilio for telephony, Stripe for payments and SendGrid for email. This makes perfect sense as developers are familiar with them and there is no real advantage for a mobile specific API technology in these general categories. There are a number of web incumbents who aggressively evolved their products to target mobile – Optimizely, Zendesk and Google Analytics are three examples. These companies should be lauded for their agility but they also face stiff competition from mobile specific startups and we will watch how their markets unfold. Mobile SDKs Need to Fight for Mindshare Due to app store approval processes, mobile app development cycles are slower than their web app counterparts. Also, the capabilities and storage of mobile devices are limited. As a result, mobile app developers are simply not willing to integrate an infinite number of SDKs. This has led mobile enabling technologies to fight for mindshare at the earliest stages of app development. Once a mobile app has integrated one analytics SDK, the bar for ripping it out and replacing it with a competitor is very high. We have observed the most successful SDKs like Mixpanel have targeted developers early with freemium offerings. Consequently, we have observed that getting your SDK distributed widely with freemium has enabled early leaders like Flurry to evolve their product offerings into other areas. Point Solutions Are Evolving into Suites Enabling technologies focused on driving engagement face stiff competition as illustrated by the highest density of logos on the landscape. As a result of this competition, we have seen this area evolve tremendously over the last six to twelve months. Companies like Leanplum and Swrve have moved from A/B testing to include customer segmentation and messaging. Mixpanel has evolved from analytics to include marketing automation features. Kahuna and Appboy have grown from just mobile marketing automation to email marketing and have displaced web incumbents like ExactTarget in accounts. This evolution is partially driven by market size and competition but also by the desire of customers to start paring down the number of vendors they integrate into their apps. The Fight on the Horizon As we look ahead, we know the number of mobile enterprise apps will continue to grow and this will benefit the ecosystem of enabling technologies. However, as enabling technologies mature, competition will increase – both from other startups and from the web incumbents who rapidly attempt to catch up. We anticipate consolidation within the major categories on our landscape, particularly as the early leaders broaden their capabilities into product suites. We realize that we have likely missed some great companies, so please let us know if we missed you. Also, if you are thinking about other frameworks to categorize mobile enabling technologies, we would welcome sharing ideas. Comments are closed.

|

Sign Up to Receive Posts via Email

All

|