|

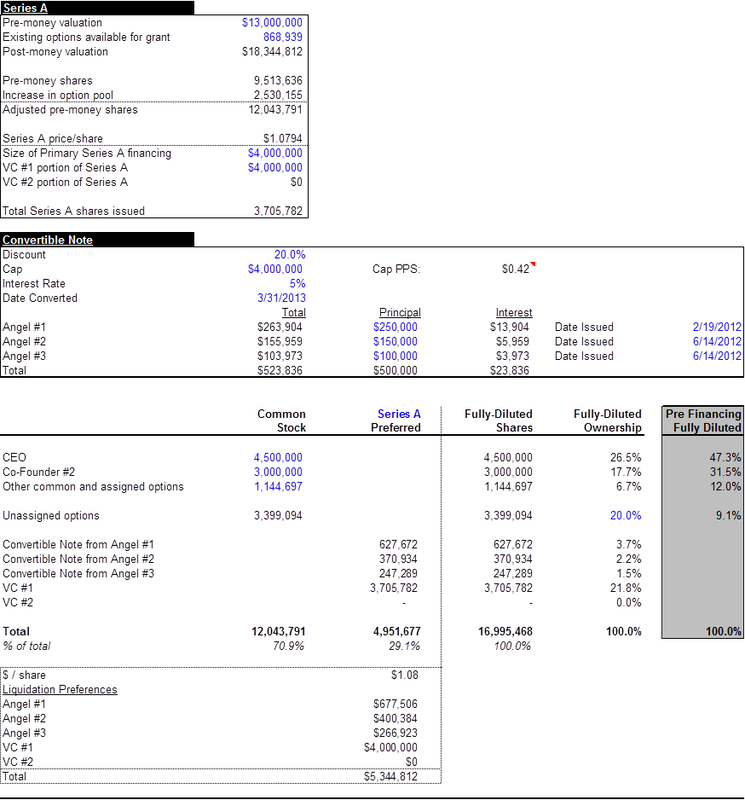

Mark Suster wrote a great post covering why convertible notes can be a hidden tax on entrepreneurs. This topic has also been fairly well covered by a number of high profile Silicon Valley law firms so I’ve just constructed a spreadsheet to demonstrate the actual mechanics and allow you to play with the inputs. In the example above, you can see that $500K of convertible notes winds up with ~$1.3MM in preferences and ~7.3% ownership because of the $4MM cap. That’s 1/3 of the ownership that the VC gets in a priced round for ~8x the money! After you’ve downloaded the spreadsheet below, you can enter in your expected scenario in the cells with blue font. Once you have your expected scenario, you may want to graph the ownership changes and a liquidation waterfall... but I’ll save that for another day. :)

Comments are closed.

|

Sign Up to Receive Posts via Email

All

|

||||||