|

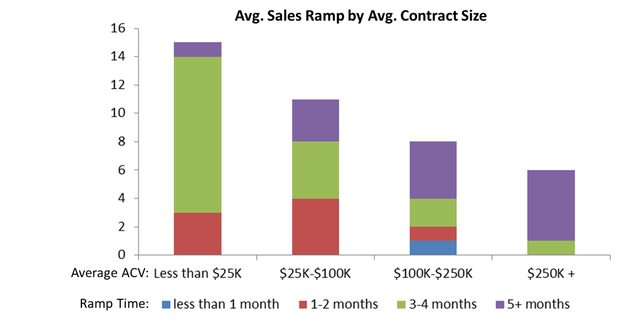

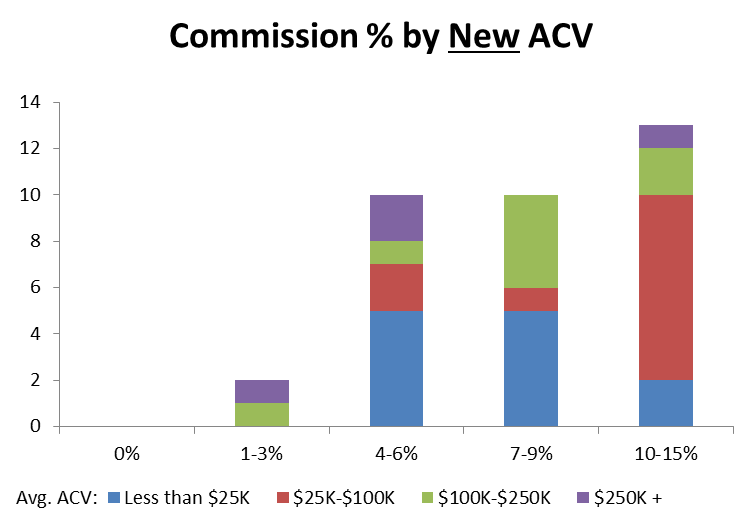

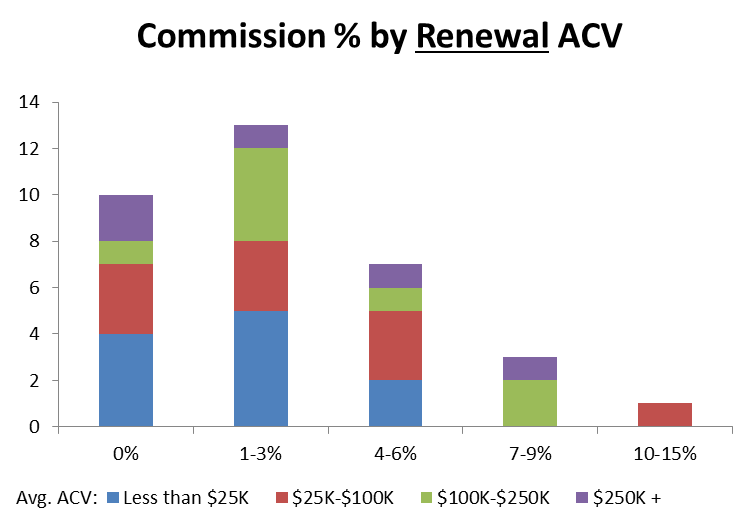

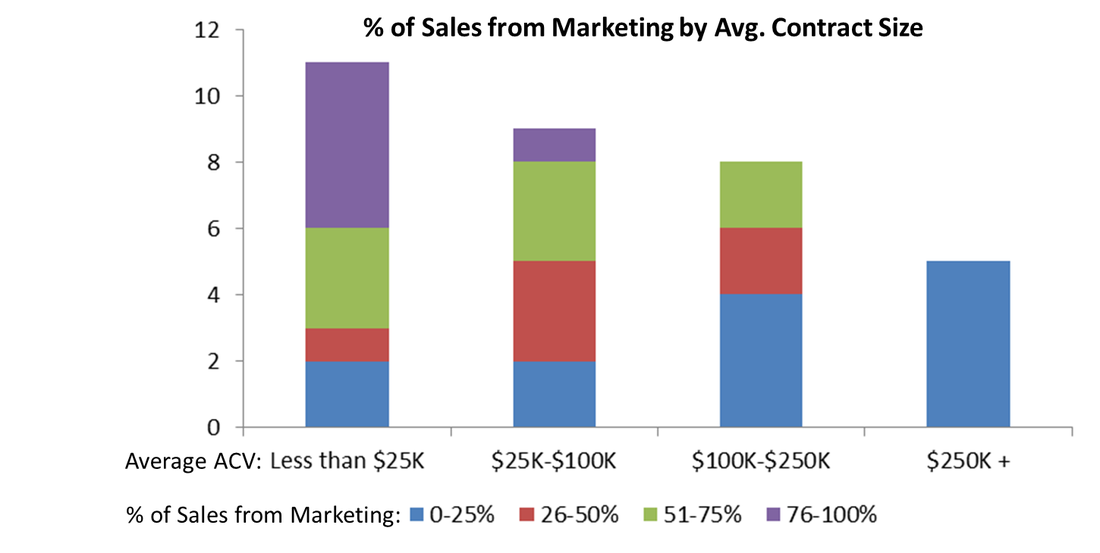

Emergence’s singular focus on enterprise applications gives us unique insights across the landscape of enterprise cloud companies and we love sharing those insights with our executive teams. We recently gathered our portfolio sales and business development leaders for our annual revenue summit. As part of the summit, we gathered data across the attendees and we wanted to share the top 10 insights. Insight #1: Companies that sell larger average contracts tend to have slower sales productivity ramps. When sales leaders begin hiring reps for larger contracts, they need to plan for that ramp time in their forecasts. Insight #2: Commissions for new ACV vary widely by size of deal. In our experience, there is more of a direct relationship to the overall quotas for reps and the commission percentages. Insight #3: Most sales leaders offer lower commissions on renewal ACV and nearly 1/3 offered no quota on renewals. We find that most of our revenue leaders have bifurcate quotas for new business to sales and renewals to customer success. Insight #4: Marketing drives the majority of sales for smaller ACV deals. This can be interpreted in two ways: one, companies with smaller average contracts need to invest more heavily in marketing to be efficient; and two, every company needs better attribution to figure out the impact marketing dollars are having on end customer sell through. Insight #5: 70% of sales leaders surveyed hired 50% or more of their reps using in-house resources. Scaling sales reps is not easy, particularly in the growth stages. The best companies build in-house recruiting organizations and tap their employees for referrals. Bonus Insight: Here are the most commonly used sales enablement tools among our revenue leaders. Thank you to all of our portfolio executives and guests for sharing your knowledge and energy at the 2014 Emergence Revenue Summit. See you next year!

Comments are closed.

|

Sign Up to Receive Posts via Email

All

|