|

Leading a startup is mentally challenging, emotionally taxing, physically demanding and hopefully deeply rewarding. You owe it to yourself to invest in your mind, body and soul so you can be your best self. In this chapter, you will learn simple techniques to optimize your health broken down into four categories: nutrition, exercise, sleep and mental health.

You are What You Eat The food you eat impacts your mood, mental capabilities, physical energy and body composition. It is that simple. We all understand this and yet our bodies are wired to fight against good decision making when we are under physical, mental or emotional stress. Thus, the most important decision you can make is to eliminate in-the-moment decision making.This sounds paradoxical, but I promise that it works and it will make your life better. For example, I have selected 3 healthy lunches that I like and one of them is ordered for me everyday. I now benefit daily from a good choice I made one time in the past. The same is true for eating out at restaurants. Look at the menu ahead of time, choose a healthy option and put it in your calendar invite so you eliminate the in-the-moment decision. Now that we’ve eliminated decisions, let’s ironically discuss what foods you should choose to eat. In general, the golden rule is to avoid sugar (and things that metabolize into sugar) and eat natural ingredients. Choose:

Avoid:

Travel Tip: Healthy choices are even harder when you are on the go. I keep RXBAR and Quest protein bars in my backpack, travel bag and car so that I always have a healthy snack option. These bars have saved me countless times from eating junk food in an airport or a candy bar in an office. Fit to Lead Your body will deteriorate if you neglect it and that will negatively impact your ability to lead a company. Consistent exercise increases brain function, improves mood and energy levels and strengthens your immune system. Most people know this and want to exercise but they can’t find the time or they lack the motivation. Here are three simple hacks that will ensure you exercise:

Now that you have no excuses, here are the guidelines to follow to get the most impact from the least amount of time. Choose:

Avoid:

Travel Tip: Right after you check in to a hotel, go look at the gym. You are much more likely to use the gym if you know where it is and have looked inside at the equipment. Also, buy elastic exercise bands and leave them in your travel bag. You can still get a great workout in your hotel room with exercise bands and bodyweight exercises (pushups, situps, squats, lunges). Sleep Your Way to the Top Low quality sleep over an extended time period has been linked to heart disease, high blood pressure, diabetes, and more. Of course, chronic stress and the late nights often required as a CEO only exacerbate the challenge of getting high quality sleep. Poor My philosophy on sleep is simple: follow a routine to develop healthy sleep habits and then prioritize quality over quantity during the week while catching up on quantity on the weekend. Choose:

Avoid:

Travel Tip: Keep an eye mask, earplugs and melatonin in your travel bag at all times. If you are traveling to a different time zone for a short trip (2 nights or less), try to maintain the same sleep/wake schedule despite the time shift. Breaking Down Mental Health Stress at work will infect the entirety of your life so it is imperative to develop good practices for keeping your mind healthy. This will improve your personal life and relationships as well as your cognitive ability and stamina at work. I highly recommend every CEO discover what methods work for them. My philosophy is to integrate mental health into other aspects of my overall well being. For example, I enjoy yoga for both flexibility and the meditation aspect. I invite others to join me on hikes so I can exercise, build a relationship with someone and enjoy the inner peace of nature. Choose:

Avoid:

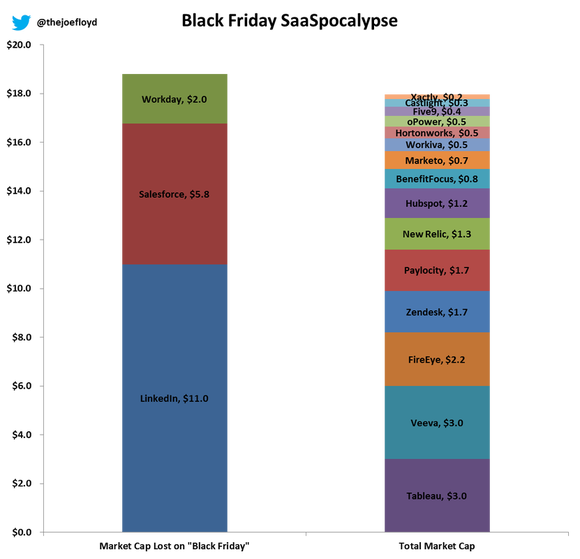

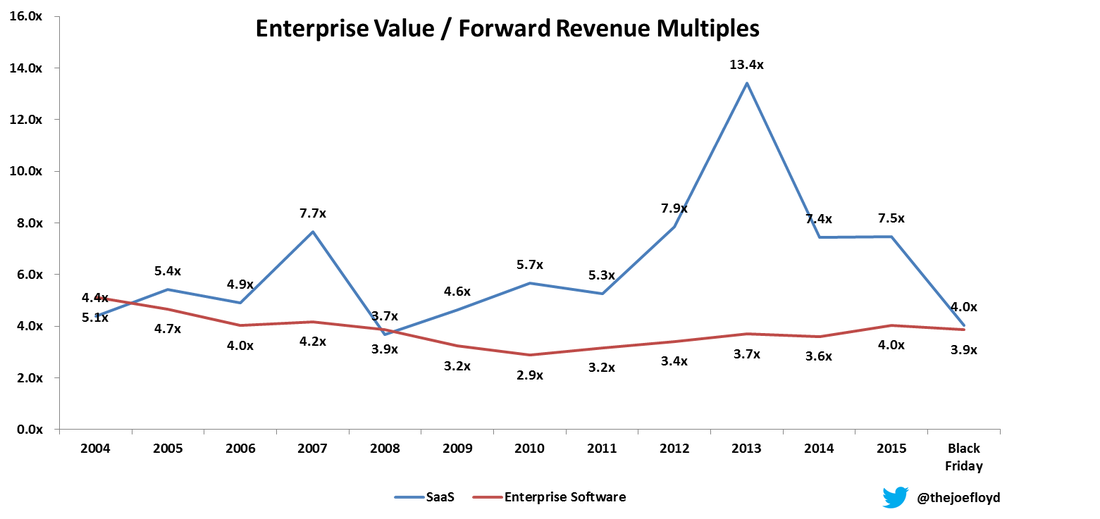

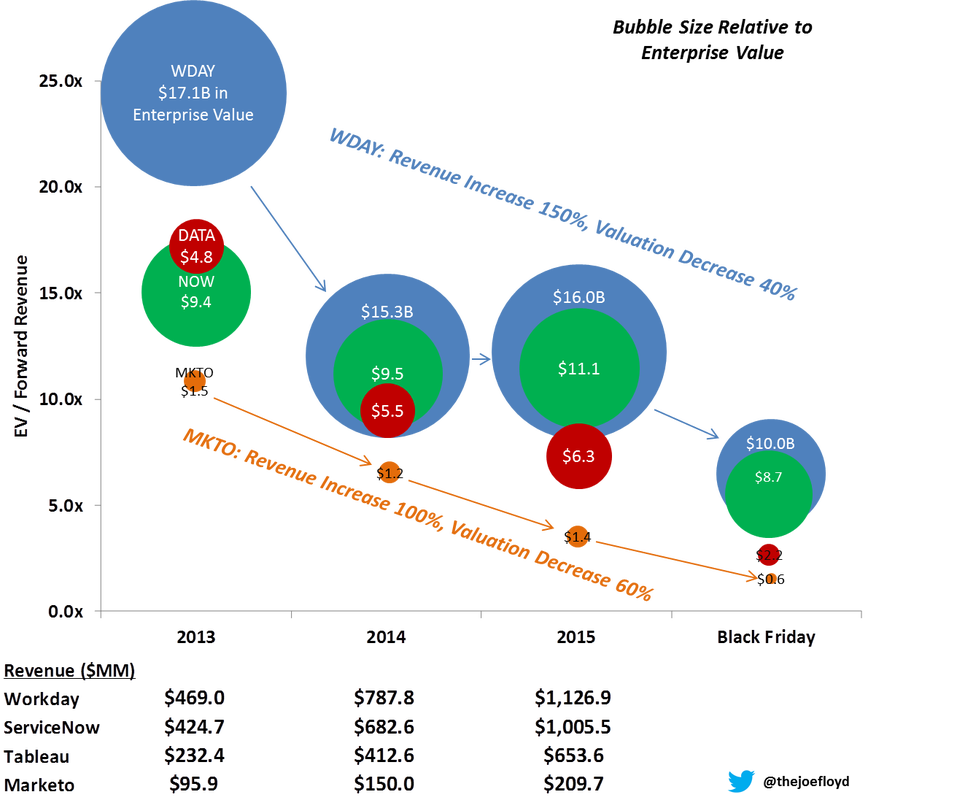

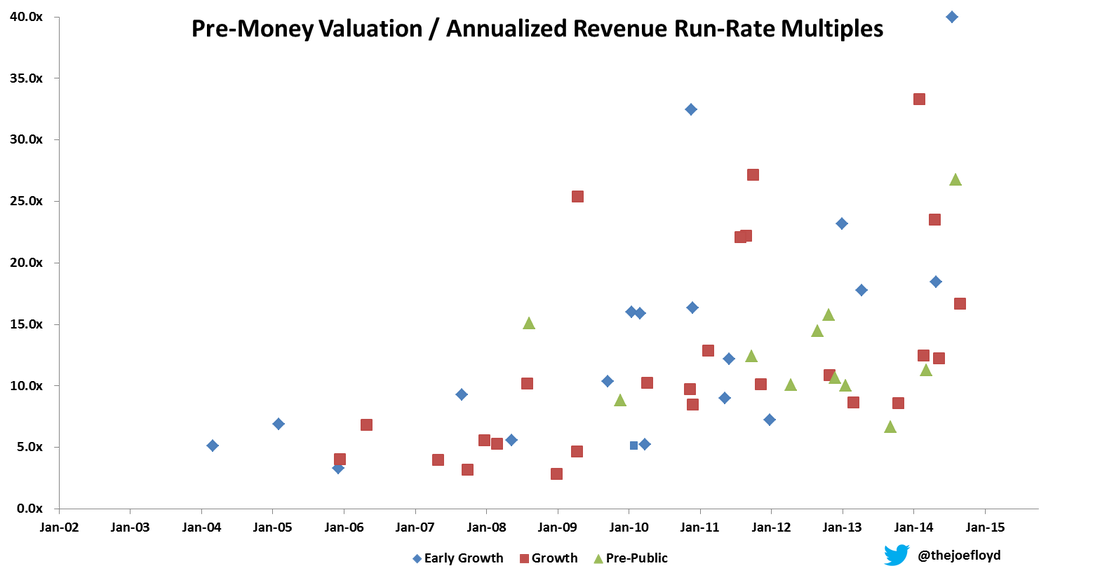

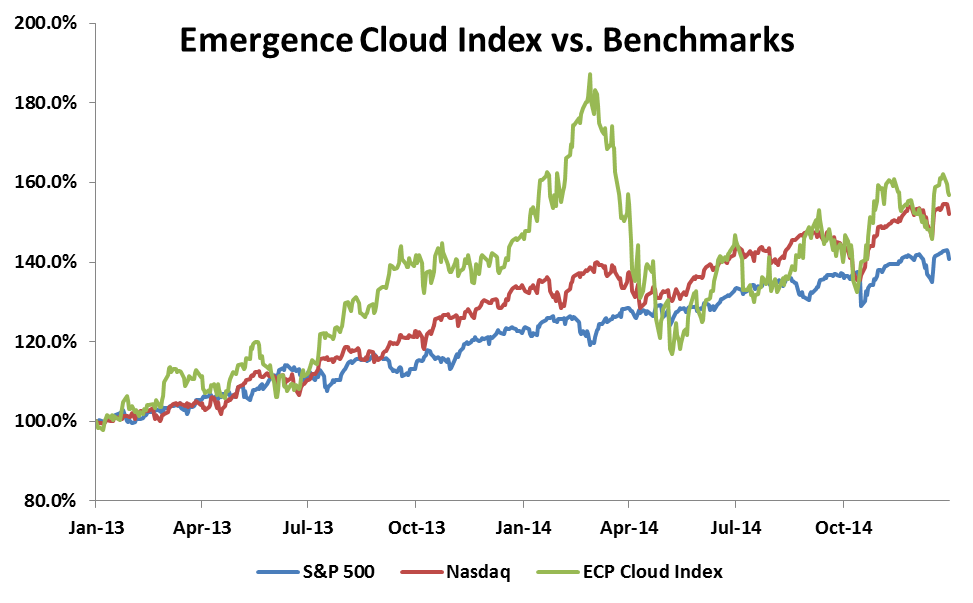

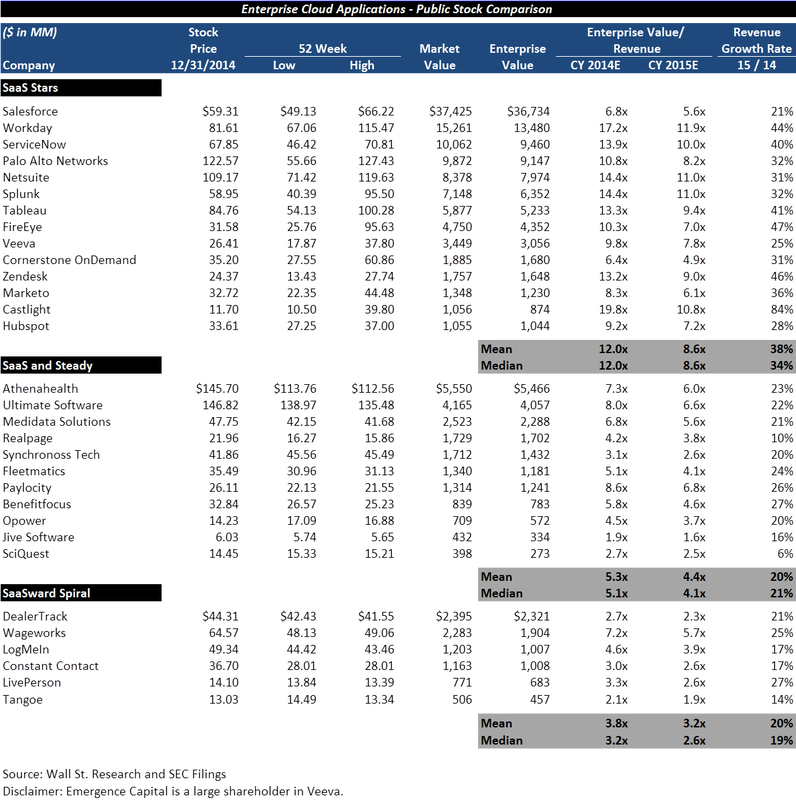

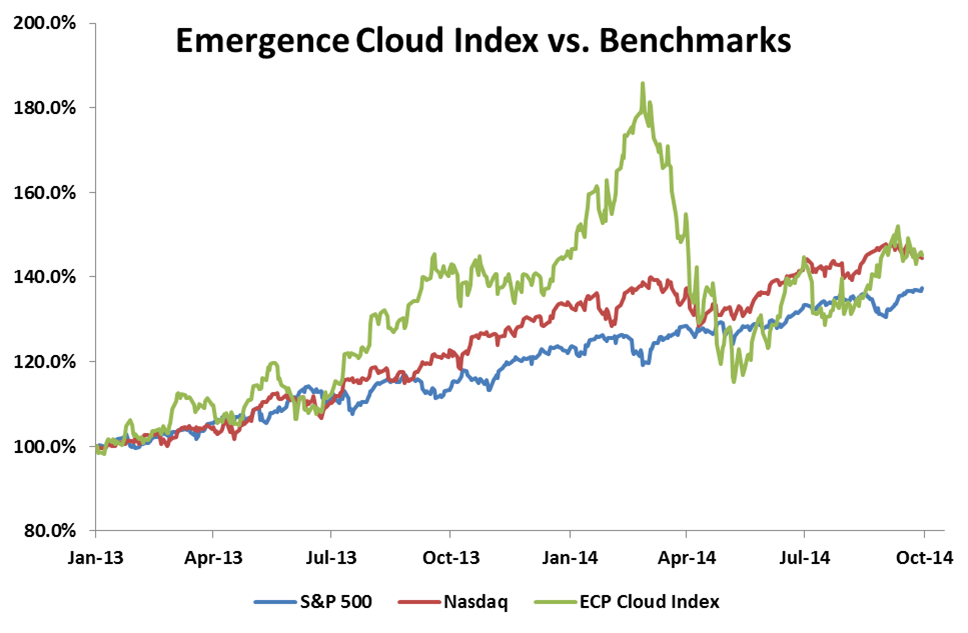

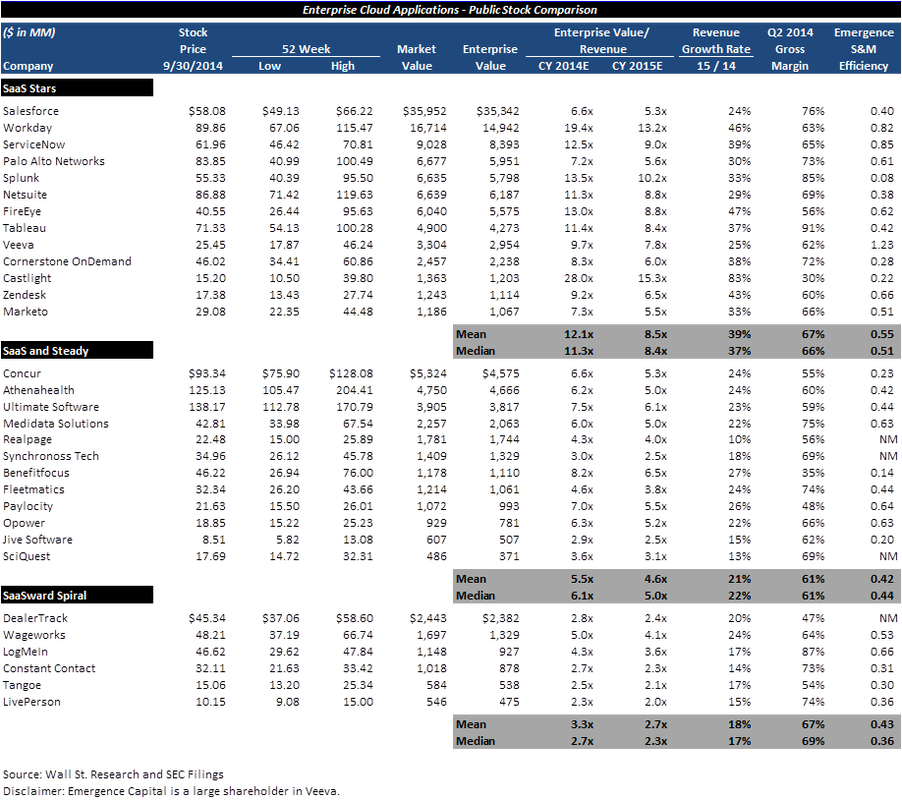

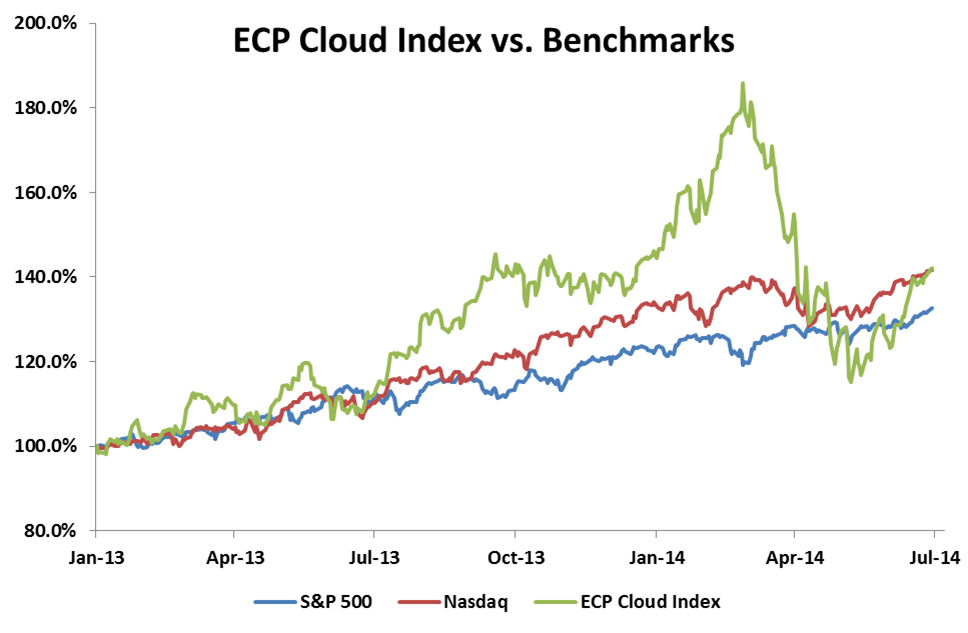

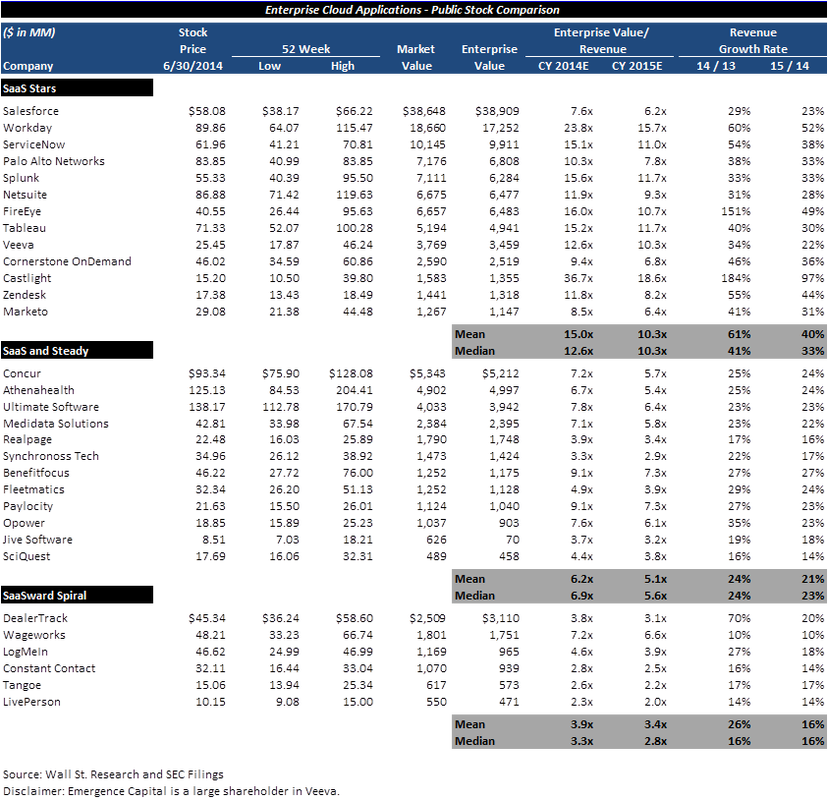

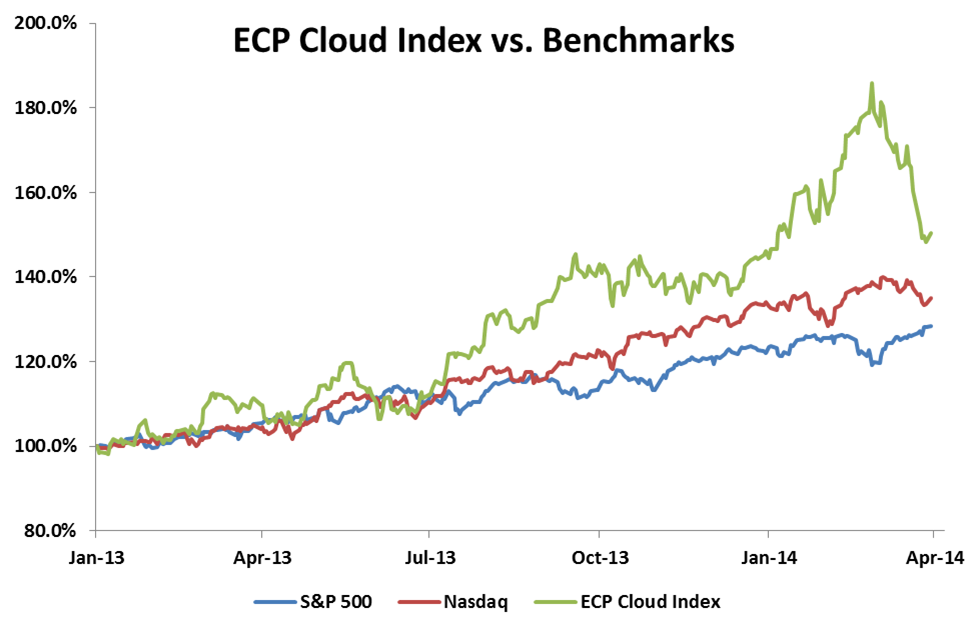

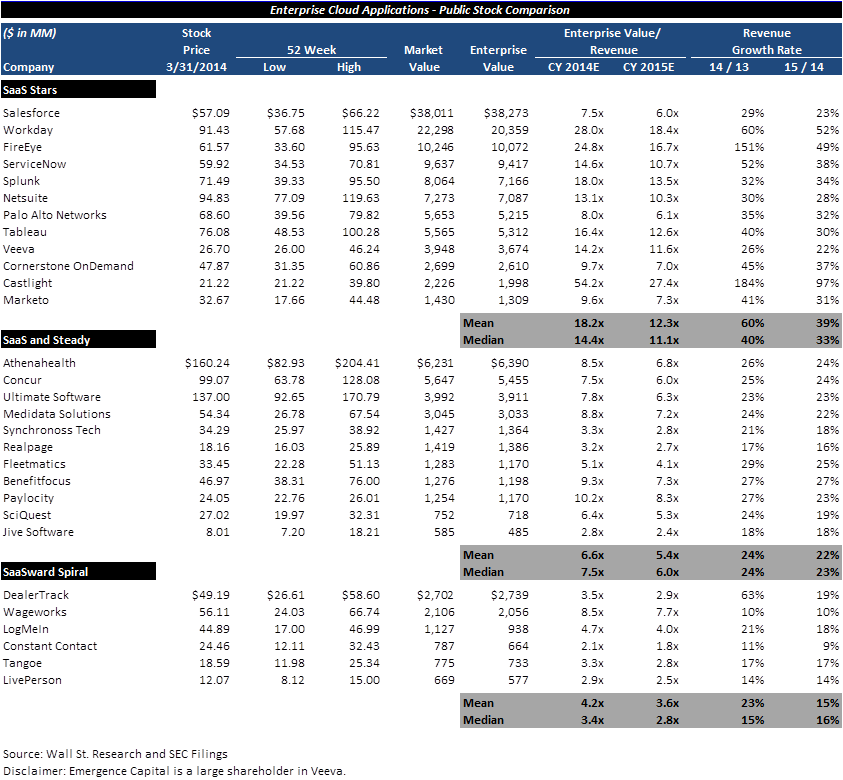

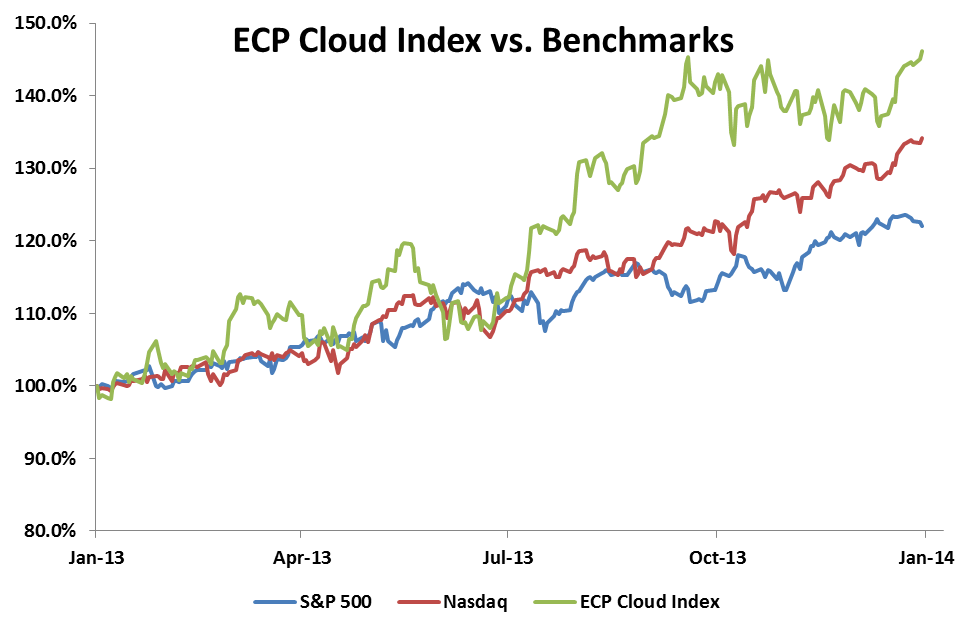

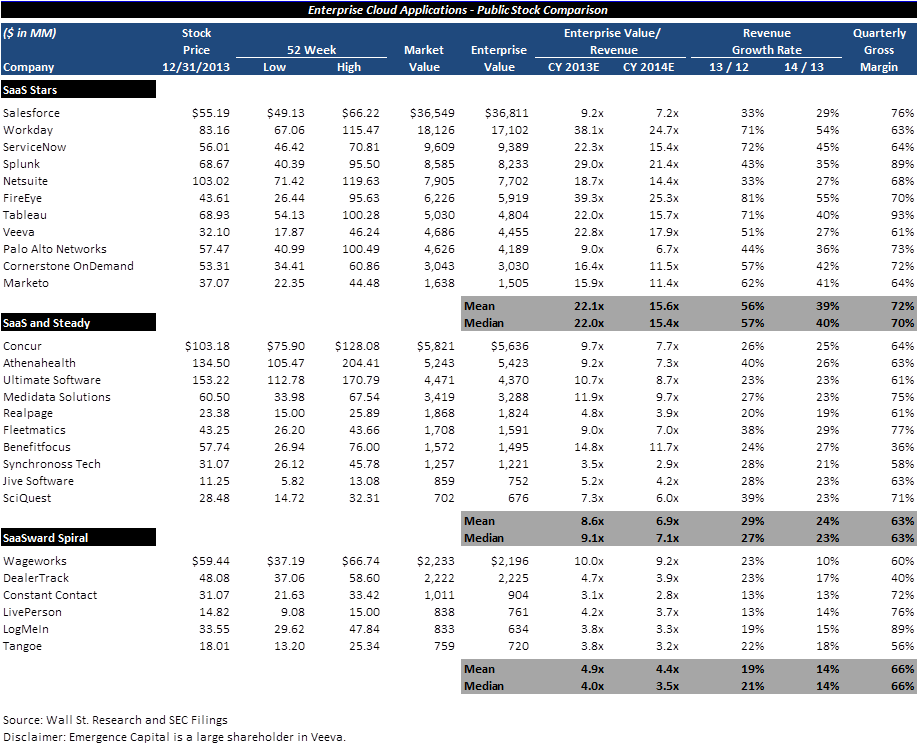

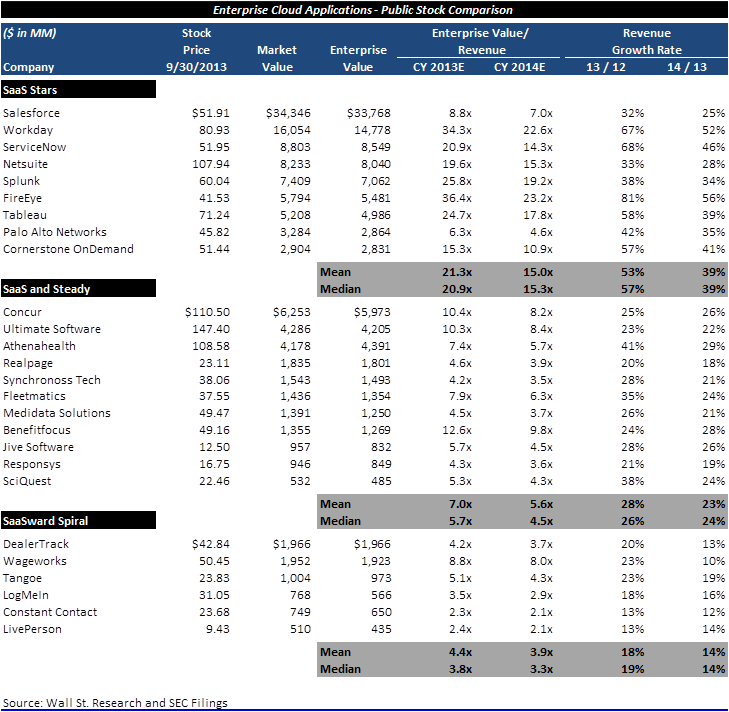

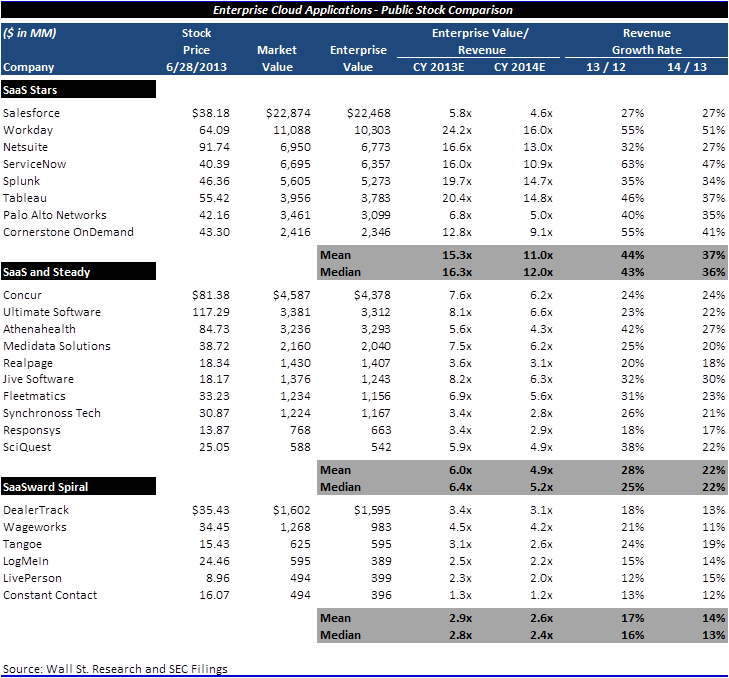

Travel Tip: Take a vacation specifically for your mental health! Explore nature, get off the grid and read books that feed your soul. There’s always more work for you to do so you have to be intentional about taking breaks so you can power through for the long term. Mind Plus Matter Think of your body and mind as a machine that needs to be fueled and maintained properly in order to perform at its peak. If you give yourself the right nutrition, exercise, sleep and mental health, then you will be at your best. Of course, I’m not a doctor so take it all with a grain of salt and find the choices and practices that work best for you. Finally, please remember that startups can be all consuming if you let them and it is important to remember that we work to live (and not the other way around). Good luck! Last Friday, LinkedIn, Salesforce and Workday lost $18B in market capitalization. To put that in perspective, these three SaaS companies lost more in market cap on Friday than 15 current SaaS leaders are worth…combined. How can this be possible? LinkedIn, Salesforce and Workday are growing revenue with sticky customers and they are targeting large addressable markets. Are they now suddenly undesirable companies? Investors Paid Yesterday for Today’s Growth On the contrary, public SaaS companies have largely met growth expectations and performed according to Wall St. expectations. The problem is that investors already paid for the projected revenue growth in many SaaS stocks a full 2 years earlier. Let’s look at historical multiples of Enterprise Value / Forward Revenue for the past decade. As you can see below, enterprise software multiples have largely held steady at 3-4x forward revenue. However, SaaS multiples began diverging in 2012 from their historical range of 5-6x forward revenue. This divergence peaked at the end of 2013 and has remained elevated above historical averages for 2 more years. The Black Friday correction brought SaaS multiples back in-line with enterprise software valuations. Like many corrections, the market has overshot to the downside as we at Emergence believe long term SaaS valuations of 5-6x forward revenue will return. Note: Enterprise Software = Microsoft, Oracle and SAP. SaaS = Athenahealth, Castlight, Concur, Cornerstone, Dealertrak, FireEye, Marketo, Netsuite, Realpage, Salesforce, ServiceNow, Splunk, Tableau, Veeva and Workday. Growth Cannot Outrun Multiple Compression Recurring revenue business models are highly valued for recurring revenue and predictable growth engines. But what happens when predictable growth is no longer valued at predictable multiples? In the chart below, you can see what has happened to 4 of the hottest IPOs of the last few years. Workday has grown revenue from $470MM to over $1.1B in 2 years and yet their market value is down 40%. Marketo has doubled revenue over the last 2 years and their market value is down 60%. This is a really painful lesson for shareholders - it does not matter how fast revenue is growing if multiples are compressing faster. There are number of factors that drive valuation multiples: future growth rates, operating margin and addressable market to name a few. For most of the public SaaS companies, the two main drivers of multiple compression have been decreasing revenue growth rates and diminishing risk appetite of investors. Lessons for SaaS Entrepreneurs So what does all of this mean for SaaS entrepreneurs? To be blunt, the issue of multiple compression is an even bigger challenge for valuations of private companies. Unlike the public markets which have regular earnings that ignite valuation changes, the private markets have very few catalysts for change. Private valuations have been driven upward by an abundance of capital pushing valuations higher and higher. You can see evidence of this trend in the scatterplot below of private SaaS valuations from the last decade. Note: Early Growth = $2-5MM ARR. Growth = $5-20MM ARR. Pre-Public is $20MM+ ARR. I excluded certain outliers.

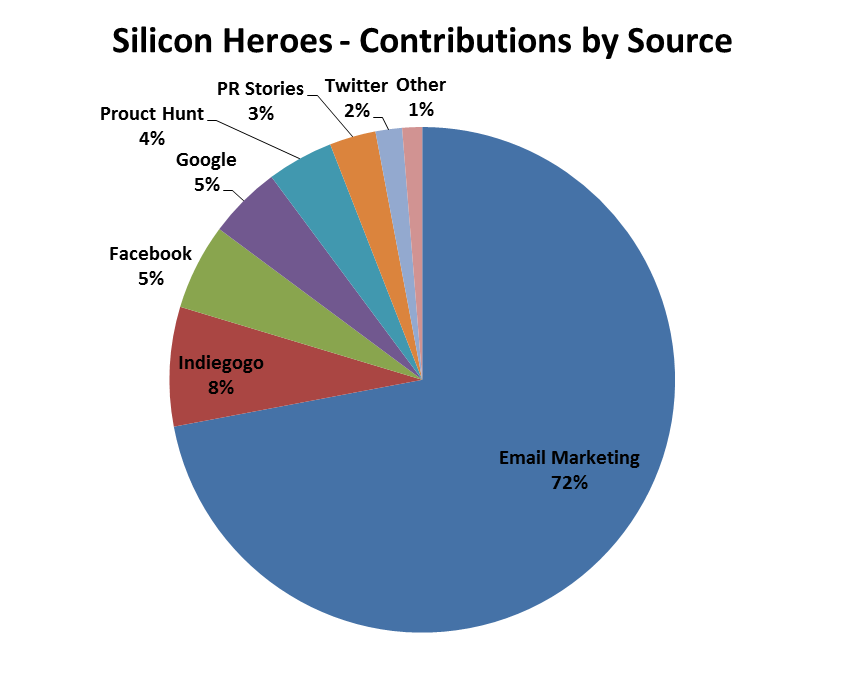

Similar to the public markets, SaaS valuation ranges began expanding in 2012. Unlike the public markets, private market valuations remained elevated through 2014. I purposefully truncated the data at the beginning of 2015 so as not to give away too much proprietary information. However, I will say that 2015 continued the trend until Q4 when fundraising became noticeably tighter – particularly in angel rounds and late stage rounds. The direct impact of a contraction in multiples is only felt when entrepreneurs are fundraising and the end result for the market is more flat/down rounds and more situations where a startup has to drastically cut burn. Here is a scenario that I’ve seen play out multiple times in the last 3 months. Hot SaaS startup raised a large Series A 12 months ago: $8-10MM at a $40MM post-money valuation. The company projected 2-300% growth on a base of $1MM ARR. Because they raised a large A, they accelerated hiring to hit aggressive growth targets and they are now burning $600K/month. Now, that same SaaS startup is at $4MM ARR and they want to raise $20MM and they expect a valuation of $100MM. Only now, multiples have compressed to 10x ARR. The entrepreneur does not like the dilution of $20MM in a flat round so there is a hard decision to make: raise less and drastically cut burn or raise what you need and suffer dilution. This situation can become a vicious cycle as sustaining growth is critical for future fundraising. This scenario oversimplifies the fundraising process and certainly every situation is different. However, the point I want to make is simple. The best entrepreneurs and best companies will be just fine fundraising even with a tightening market. It’s the startups with challenging cap tables, cost structures or market timing issues that will really struggle to fundraise. Black Friday isn’t the canary in the coal mine – it should be the last wake up call for SaaS entrepreneurs to take a good look at their business and make absolutely certain that they have a contingency plan for 18 months of cash. P.S. If you want to preserve cash without cutting costs, here are 5 cash flow hacks for SaaS startups. This post originally appeared in TechCrunch. We launched Silicon Heroes 12 days ago (http://bit.ly/siliconheroes) which means the first wave of marketing has run its course. The first wave was strong – email marketing to ~1,500 people, #1 on Product Hunt books and 3 great PR articles written about us. This first wave powered us all the way to over $40K in the first week. Of course, since this initial burst of marketing activity was done, I needed to find ways to sustain the crowdfunding contributions or else growth would flatten out (since I’ve exhausted all my friends). I tried out 3 marketing ideas this past week and here’s what I learned from them over the past few days.

#1 – Facebook Ads Wow, I’ve learned a ton about Facebook ads in the last week. First, I learned that the new Facebook pixel does not work with Indiegogo. This only took me $100 with zero conversions to figure out. Luckily that was essentially free money (it’s great to have friends at Facebook). After some back and forth with Indiegogo’s support, I figured out that the old Facebook conversion pixel will still work (though it limits what you can track). I then decided to limit Facebook ads to $20/day and I started running two types of campaigns. The first uses look alike targeting which looks at the 50 customers who have contributed to Silicon Heroes (that I did not already know) and then targets people with similar profiles. The second campaign just targets people between 18-50 who like tech (occupation or interest), comics (Marvel movies, comic books) and Girls Who Code or Code.org. My audience was about 5MM so I figured this was big enough. Here are the results: Just targeting based on demography and interests resulted in ~$13 CPM and 0 conversions. Ouch. Using the look alike audience with some targeting resulted in ~$18 CPM with 2 conversions (from 21 clicks). This ad unit basically broke even. I spoke with a couple buddies who do a lot of Facebook ads. They were both surprised by how ineffective my ad campaigns were. They had a whole bunch of suggestions – splitting up my audiences into thin slices (between 100,000 and 200,000 person audiences) and then running a lot more campaigns (testing different combinations of creative, messaging and audiences). They also looked at my stats and quickly steered me away from mobile (which does not convert well on Indiegogo). Some great suggestions and I’ll try a whole new series of tests this week. #2 – Content Marketing I wanted to create unique content related to Silicon Heroes that was easy to produce and shareable. So I went on Upwork and hired a few artists to sketch famous entrepreneurs as superheroes. I then hired another person to use inspirational quotes from these entrepreneurs and make them into little shareable pieces of content for Twitter, Facebook, Instagram and Pinterest. Each piece of content costs me ~$7 and I’ve created about 50 (though I’ve only distributed 6 or 7 so far). See the image at the top of this post for an example. My plan was to see if I could convince some of the famous entrepreneurs to tweet the sketches out. Wow…that did not work. Most entrepreneurs were flattered by the sketches but they so far have had zero interest in sharing the images. My guess is that they are worried about looking arrogant or vain for posting a picture of them as a superhero. No big deal. So I’ve just been pushing out some of the sketches from my own accounts and the Silicon Heroes accounts. Unfortunately, I haven’t gotten much reach with the images and it’s also difficult to measure the impact for some of the channels. Twitter gets the least interaction (1-2 likes per image) whereas Instagram gets the most (30-50 likes per image). Unfortunately, Instagram doesn’t allow you to embed links. You can put them in the comment, but they are just text (not hyperlinks) and therefore not trackable. So far, I’ve received no Indiegogo contributions via these images on Twitter, 1 from Facebook and I don’t know the results from Instagram. If there is a lesson learned here, it’s that I probably should have only made 5 or 10 entrepreneur sketches so I could have figured out early on that the CEOs weren’t comfortable sharing them. Without their boost, it’s been tough sledding on Twitter and I doubt I’ll see ROI. However, content marketing really tends to stack as you push out more content so hopefully I’ll see the same effect (and maybe ROI will come later). #3 – Automated Twitter Marketing I came up with this crazy idea to create a bot that would automatically respond to everyone who liked, replied or retweeted any of the content related to Silicon Heroes. For example, the article I wrote in Entrepreneur that described a little of the backstory for Silicon Heroes has been shared over 3,000 times. I could search for any time the link to that article had been shared and then I could automatically tweet the person who tweeted the article link with a message that says “Thanks for sharing. Did you know you can buy a copy of Silicon Heroes here…”. Great idea, but apparently this is difficult to execute without pissing off Twitter. I’m still working on it so if anyone has any ideas, I would greatly appreciate it. Chasm Not Crossed It was a busy week of experimentation and I definitely did not figure out how to keep growth going for the Indiegogo campaign. We added about $3K in contributions during the last week, but sadly almost all of these contributions came from people that were emailed during the 1st week (so they weren’t attributable to the new marketing tactics). I’m going to continue experimenting with Facebook ads this week – smaller target audiences with more focused messaging. I’m also going to see if I can’t crack this Twitter bot and I’ll start sending out some cold email campaigns to people that like tech and comics. I’ll report back next week. Wow! Thank you to everyone who has supported shared and liked Silicon Heroes on Indiegogo. We crushed our goal of $31,415 (pi to the 4th digit) early on Day 2! We are now over $39,000! Amazing! We have now covered all of our fixed costs so the majority of every new contribution will be donated to Girls Who Code and Code.org! |

Sign Up to Receive Posts via Email

All

|